Short sell calculator

Short Call Calculator Search a symbol to visualize the potential profit and loss for a short call option strategy. An Easy to Borrow or.

Call Option Calculator Put Option

Bearish Limited Profit Unlimited Loss A simple but risky strategy which results in an initial credit.

. By selling a call you are liable to sell 100 shares of the underlying stock at strike price A if assigned. Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage. To calculate the return on any short sale simply determine the difference between the proceeds from the sale and the cost associated with selling off that particular position.

These are trades you typically want to open and close same day. Theyre taxed like regular income. Desired selling price.

Daily short sale volume traded on NASDAQ NYSE and OTC. Our home sale calculator estimates how much money you will make selling your home. There are a few reasons why one would be interested in trading low float stocks.

The Stock Calculator is very simple to use. To calculate float you take the total outstanding shares and subtracting the closely-held and restricted shares. A Hard to Borrow Stock.

It can also be calculated as net income divided by revenue or net profit divided by sales. The rate of return for a short sale is calculated by the following formula. What is a short call.

Its essentially the opposite of long position investing. Intraday short selling strategies allow you to make money on bearish moves. Stock Short Sell ProfitLoss Calculator Short Sell Shares Symbol Short Sell Price Short Repurchase Price Sell Shares Commission Repurchase Commission Sell Data Percent Drop in Price Share Price Break even 0 ProfitLoss Short Purchased For.

Aside from having a margin account shorting a stock requires having your broker locate the shares for you to short -- you are borrowing someone elses shares and selling them with a promise of returning them back in the future. The 1750 is based on an initial margin requirement of 50. If the stock price goes down it will result in a gain.

Check the impact several margin trades will have on your overall margin balances. Short-term capital gains are gains you make from selling assets that you hold for one year or less. Build Your Future With a Firm that has 85 Years of Investment Experience.

On the logistics side on being able to short stocks it requires a few more steps as compared to getting long stock. Short selling stocks is an advanced trading strategy used either to hedge or speculate the anticipated decline in stock price. So the rate of return in Example 1 for the profitable investment is 3500 - 140 - 3000 1750 360 1750 2057 while the return of return for the investment loss 640 1750 3657.

ESTIMATED NET PROCEEDS 269830 Desired selling price 302000 Remaining mortgage owed 0 Est. Short selling also known as shorting selling short or going short refers to the sale of a security or financial instrument that the seller has borrowed to. The maintenance margin is then calculated based on the market value of the short.

There are two factors for daily costrevenues associated with short selling of stocks and bonds at IBKR. If it goes up it will result in a loss. Volume and short volume of a stock in the chart are.

10868-187 -169 Trade Time. Writing or selling a call option - or a naked call - often requires additional requirements from your broker because it leaves you open to unlimited exposure as the underlying commodity rises in value. Just follow the 5 easy steps below.

That means you pay the same tax rates you pay on federal income tax. Daily Short Sale Volume Symbol Time Period Alphabet Inc. Selling costs 1065 32170 Selling price mortgage The amount youd like to to sell your home for and total remaining mortgage amount.

Short Sale Proceeds interest paid to you by IBKR. Fidelitys Margin Calculator lets you calculate the impact of hypothetical equity trades on your margin balances and buying power while also factoring in the specific margin requirements for your account. Per Share Collateral Amount x Share Quantity Trade Value.

So if the stock price increases to 60 then the market value of the short sale is 60000 60 x 1000 shares. With the Margin Calculator you can. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Long-term capital gains are gains on assets you hold for more than one year. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling stocks Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Theyre taxed at lower rates than short-term capital gains.

This value is then. Market price of stock x 102 Per Share Collateral Amount. Next multiply the trade value by the annual hard-to-borrow rate.

Naked Call bearish Calculator shows projected profit and loss over time. The step-by-step hard-to-borrow fee calculation looks like this. For instance a 30 profit margin means there is 30 of net income for every 100 of revenue.

Sell Short 100 of SNAP. Sep 02 160004 EST Short Interest Ratio. Next you take the per share collateral amount and use it in another calculation.

The weighted average rate can be computed on the calculator here.

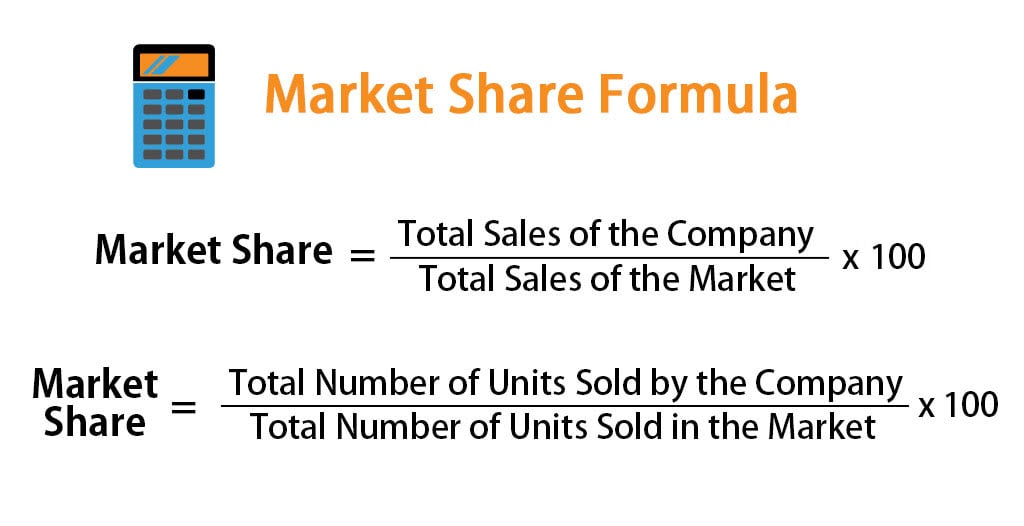

Market Share Formula Calculator Examples With Excel Template

/dotdash_Final_What_is_The_Short_Interest_Ratio_Dec_2020-01-b833e4d69d4e45c98baf43a92e4adc44.jpg)

Short Interest Ratio Definition

Stock Calculator

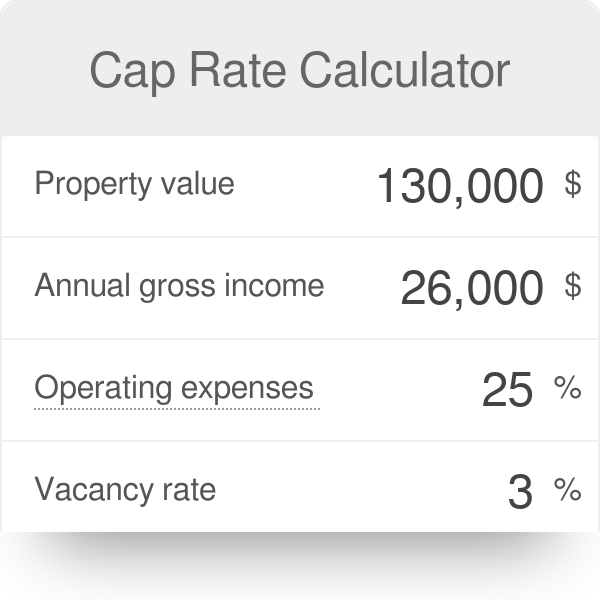

Cap Rate Calculator

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

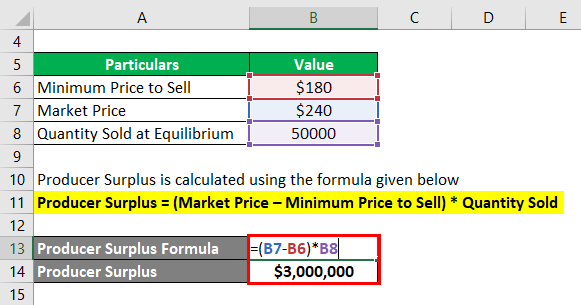

Producer Surplus Formula Calculator Examples With Excel Template

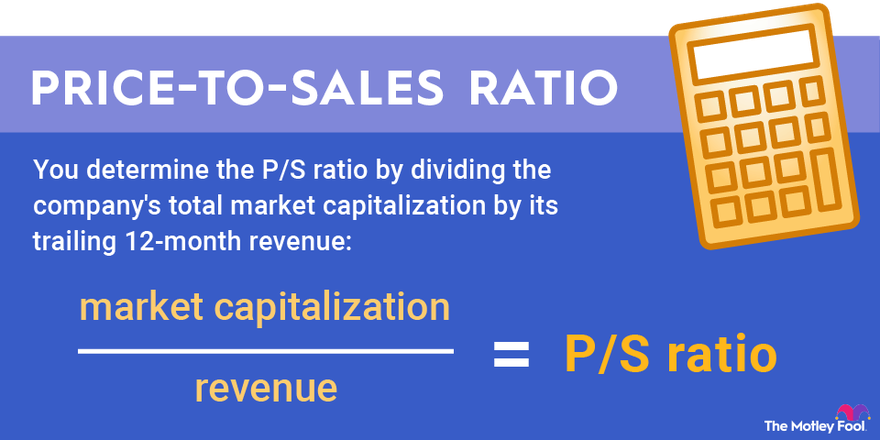

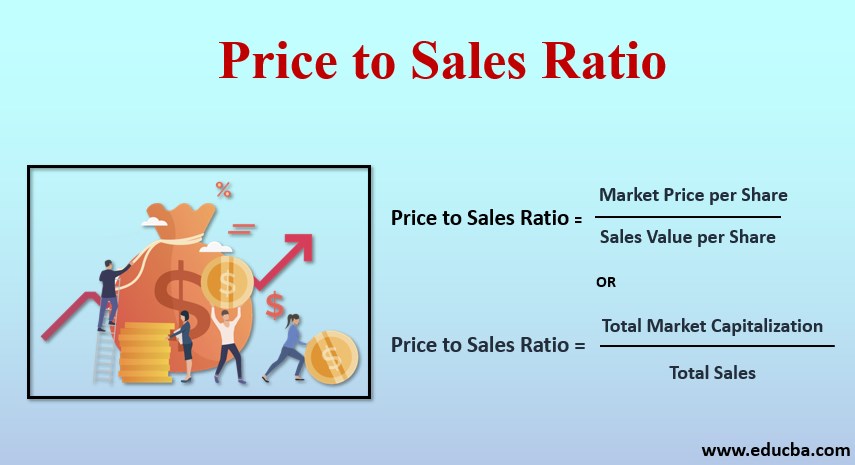

Price To Sales Ratio Defined

Vat Calculator

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

What Is Discount Yield

Sales Tax Calculator

Zero Coupon Bond Formula And Calculator Excel Template

Cost Of Goods Sold Cogs Formula And Calculator Excel Template

Amazon Book Sales Calculator Tck Publishing

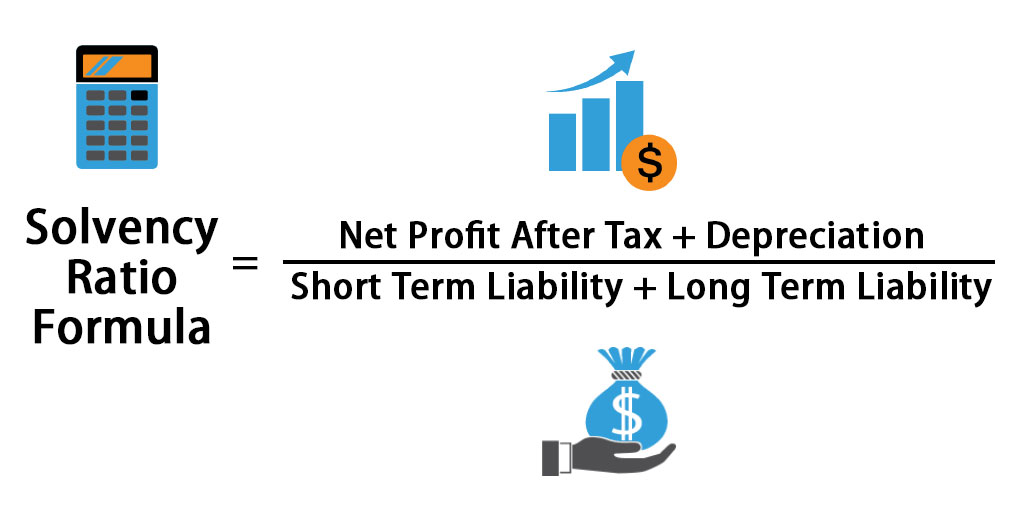

Solvency Ratio Formula Calculator Excel Template

Amazon Book Sales Calculator Tck Publishing

/GettyImages-1145216807-2549be84bb2f462bb8b2f250232aa3e8.jpg)

Calculating Profits And Losses Of Your Currency Trades